How Is TVA's PILOT Calculated?

TVA’s PILOT is based on 5% of its prior-year gross proceeds from power sales excluding direct sales to federal agencies. The PILOT is divided among the eight states where TVA has power property, which includes not only facilities that generate electricity but also coal assets, property used to transmit electricity, and a portion of the overall value of TVA’s reservoir properties.

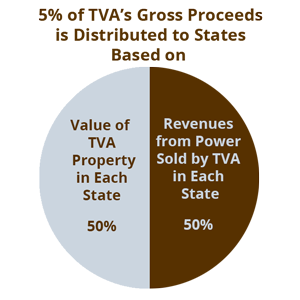

Each state’s allocated amount is based both on revenue from power sold by TVA in each state and on the value of TVA power property located in each state:

- Half of TVA’s PILOT is allocated based on the percentage of TVA’s power revenue that comes from each state.

- Half is allocated based on the percentage of TVA power property located in each state as determined by each property’s value.

Each state determines how to distribute its share of the PILOT remaining after the following adjustments:

- Out of each state’s allocated amount, the counties in which TVA owns power property receive direct payments from TVA equal to the average property taxes levied by the county (including those levied by tax districts within the county) for the last two years in which the property was privately owned.

- In states where TVA operates power property owned by another entity, the property’s value is still used to determine the state’s allocated amount of the PILOT, but TVA reduces its actual payments to the state to the extent that it reimburses the property’s owners for taxes they must pay to the state or local governments.

Mississippi is currently the only state in which TVA operates power property owned by another entity—the Caledonia Combined Cycle Plant in Lowndes County.

See sections 13 and 15 of the federal TVA Act.